-

PDF

- Split View

-

Views

-

Cite

Cite

K. Vela Velupillai, Iteration, tâtonnement, computation and economic dynamics, Cambridge Journal of Economics, Volume 39, Issue 6, November 2015, Pages 1551–1567, https://doi.org/10.1093/cje/bev051

Close - Share Icon Share

Abstract

An attempt is made, in this paper, to extract a mathematical methodology, underpinned by numerical meaning, from a study of Richard Goodwin’s classic contributions from 1943 to 1967, and beyond. The key conceptual notions used are tâtonnement, computation, approximations, the geometry of dynamics, simulations and iteration.

1. Dynamics, computation, approximations, geometry and simulation in Richard Goodwin’s economics

In the continuing effort to erect a useful [economic] dynamics, we need all possible helpful sources of hypotheses. One such is the traditional mathematical device of solving equations by trial and error and its vigorous modern step-child the automatic computing machineor zeroing servo. (Goodwin, 1951 B, p. 1, emphasis added)1

Those of us who had the privilege to attend Richard Goodwin’s lectures, at Harvard, Cambridge or Siena, regularly over a period of almost half a century, know the wonderful—yet difficult—ways in which he used his considerable artistic skills to illustrate (sic!) the geometry of complex economic dynamics. It was, after all, this particular way of understanding planar dynamics that enabled him to devise the famous one-sided oscillator, motivated by the economic intuition that the Hicksian ‘floor’ was not a necessary condition for the maintenance of oscillation as a limit cycle.2

Those others of us, even if we did not have the pleasure and privilege of attending his normal series of lectures, who struggled through to eventual enlightenment by reading—and re-reading—and working through the many classics on non-linear and multisectoral macrodynamics, quite apart from being impressed by the ingenious geometry, were also struck by his systematic use of simulations.3 He struggled to convince himself and his readers that plausible empirically sensible numbers for key parameters, in the relevant range for crucial variables, made economic sense. Indeed, this was manifested in all his classics, between ‘Keynesian and Other Interest Theories’ (Goodwin, 1943) and the ‘Growth Cycle’ (Goodwin, 1967), including the remarkably original Elementary Economics from the Higher Standpoint (Goodwin, 1970).

On the other hand, after discovering that Otto Rössler had ‘simplified’ the famous Lorenz equations in the same qualitative way he had generated a one-sided oscillator,4 i.e. reducing the two non-linearities in the three Lorenz equations (in (4) & (5)) to one (in (8)) whilst preserving the exotic dynamics of its attractors, Goodwin spent almost the whole of the last decade and a half of his life trying to understand the richness of a three-dimensional ‘growth cycle’, fusing the economic theories of three of his (four) maestros: Marx, Schumpeter and Keynes (Goodwin, 1990), with extensive simulational studies. The ‘fourth’ maestro was of course Wicksell, who was important for the many ways Goodwin tried to make sense of capital theory, especially in its post-Sraffian phase (Goodwin, 1970), and population dynamics (cf. Goodwin, 1978).

However the ‘Growth Cycle’ (1967) highlighted a different strand in Goodwin’s methodology in formulating analytical models of macrodynamics, both aggregative and multisectoral: theoretical simplifications, ‘stark schematisations’ and approximations of ‘reality’, whatever that means in any particular context. Thus the opening sentence of the ‘Growth Cycle’ was: ‘Presented here is a starkly schematized and hence quite unrealistic model’ (Goodwin, 1967, p. 54 emphasis added).5 Paraphrasing Sraffa’s famous Corfu aphorism on ‘measurement in theory’ versus ‘measurement in practice’ (Sraffa, 1961, pp. 305–6), the latter referring to the domain of the statistician, it is not an exaggeration to claim that Goodwin’s art of theorising was to utilise, in a fertile way, the distinction between ‘approximation in theory’ versus ‘approximations for solvability’.6 The ‘approximation in theory’ that I associate with Goodwin’s art of theorising is the one routinely practised by the pure mathematician; that which I call ‘approximation for solvability’ is one I associate with the applied mathematician (and the engineer).

One linear mathematical device, used extensively by applied mathematicians seriously interested in constructing empirically applicable models, was the idea of coordinate transformation. It is variously known as normalised general coordinates, orthogonalised coordinates or systems to study normal modes. Goodwin mastered the art of using this fertile way of transforming and decoupling linear interdependence to make it simpler to analyse dynamics at a very early stage of his intellectually productive life, i.e. from about the mid-1940s.

He mastered the art of analysing, geometrically, the non-linear dynamics of planar systems (at the feet of Le Corbeiller) from about the early 1940s. By 1946 he had mastered the first volume of Hilbert–Courant, the classics by Birkhoff–MacLane and Whittaker (cf. Goodwin, 1949, p. 549, where both of these books are referred to precisely for coordinate transformation results) and Frazer–Duncan–Collar (cf. Goodwin, 1953, p. 86), on the linear side. The application of normal mode or normal coordinate transformation to the kind of multisectoral economics he was developing, from Goodwin (1947) all the way to the end of his life, was always for the purpose of being able to compute solutions to economic problems.7

Goodwin was never interested in proving8 the existence of anything, especially equilibrium, in any economic model, aggregative, disaggregative, multisectoral or whatever. But his analytical visions—in the strict Schumpeterian sense—were wholly dominated by ensuring solvability, interpreted in any way, formal, constructive or computable, whether by means of a digital or an analogue computing machine or simply using ‘paper and pencil’, a mode made a veritable art by this accomplished painter. There is not a single instance, in any of his classics, that a solution to a problem was derived without also considering methods to find the solution. Here, a Turing precept was invoked—albeit implicitly:

No mathematical method can be useful for any problem if it involves much calculation.

(Turing, 1954, p. 9)

This adds another consideration, which was paramount in all Goodwin’s mathematical contributions to economic analysis: a starkly schematised theory, highlighting the essentials under consideration—most elegantly carried out in the ‘Growth Cycle’—was one ingredient; but such a schematisation was always underpinned by mathematical methods of solutions, sometimes geometrically executed, at other times numerically explored, that were tractable (in the sense in which the word ‘tractability’ is used in computational complexity theory), i.e. methods of solutions to problems that did not involve too much calculation, in the above Turing sense.

Methods of solutions, for Goodwin, always meant computing methods; and computing methods were, of course, those implementable in computing machines—first in machines of the servomechanism type, then via analogue computing machines9 and, finally, in the last period of his life, in digital computers. Hence the relevance of the opening quote of this section, with the prescient phrase: ‘mathematical device of solving equations by trial and error and its vigorous modern step-child the automatic computing machine or zeroing servo’.

To the best of my knowledge, Goodwin never mastered the art of programming (pace Knuth). This was not any disadvantage in the era when feedback control theory—or servomechanism theory—and analogue computing were the dominant machine models of computation. The crucial role of a mastery of the art of programming may have forced Goodwin, in the late 1970s and for the rest of his life, to learn to program, if not for the fact that the burgeoning availability of, first, the desktop and, later, the laptop computer, and its ever smaller variants, came with specialised and ready-made computer programs that enabled him to indulge in copious simulation studies, even of complex, multisectoral, non-linear dynamical systems—often in difference forms too.

If I were to summarise my vision of Goodwin’s mathematical approach to analytical economics in one simple precept, it will be the following uncompromisingly constructive principle, underpinned by the computable approach to problem solving:10no solution to a problem is satisfactory without an accompanying method to determine its solution. The orthodox economist may use the word ‘existence’ as synonymous with ‘solution’ (but he/she will be wrong to do so); if so, the precept is even more definitively constructive: no proof of existence is legitimate—mathematically and epistemologically—unless accompanied by a method to determine it. But it was left to Goodwin’s great and innovative powers of imagination, coupled to his sensitive mastery of the geometry of dynamical systems, that we owe the absolutely pioneering link he made between dynamics, numerical analysis and computation, a topic at the very frontiers of all three of these fundamental topics in modern applied mathematics (cf. Stuart and Humphries, 1996). This link, against the backdrop of what I have called Goodwin’s constructive principle, was noted by a remarkably prescient observation by Arrow, Karlin and Scarf, long before computable economics was even conceived (at least in my mind):

The term ‘computing methods’ is, of course, to be interpreted broadly as the mathematical specification of algorithms for arriving at a solution (optimal or descriptive), rather than in terms of precise programming for specific machines. Nevertheless, we want to stress that solutions which are not effectively computable are not properly solutions at all. Existence theorems and equations which must be satisfied by optimal solutions are useful tools toward arriving at effective solutions, but the two must not be confused. Even iterative methods which lead in principle to a solution cannot be regarded as acceptable if they involve computations beyond the possibilities of present-day computing machines. (Arrow et al., 1958, p. 17, emphasis added)

I would like to end this section with a very personal ‘story’ of Goodwin’s typically diplomatic ways of not referring to the classics, but still remaining faithful to them. In 1978 I met Arne Jensen,11 the distinguished Dane who had been a student of A. K. Erlang and a past president of International Federation of Operation Research Societies (IFORS), in Vienna, where I was presenting a paper at an International Federation of Automatic Control (IFAC)/IFORS conference. Over a pleasant after-dinner drink at the Moulin Rouge in Vienna, together with Gregory Chow and Berc Rustem too, we reminisced (although at that point in time I did not have much to reminisce about!) and the fact that I was a student of Richard Goodwin surfaced in the conversation. Arne Jensen then remarked that he had been at Cambridge in the mid-1950s and had, in fact, enjoyably attended Goodwin’s lectures. After one of the lectures Jensen had approached Goodwin and asked him why he did not refer to Walras, although the whole subject matter of that lecture—and many of the previous lectures—had been on the Walrasian system. Goodwin is supposed to have replied:

Look, I am an American economist trying to make my living in Keynes’ Cambridge. If I have to refer to anyone before Keynes, I must first try to do so by invoking Marshall; failing that, I have to refer to someone in this faculty or university. If I fail in that, too, then I must find a name in that ‘other’ place, Oxford. Only if I fail in that as well would I refer to anyone else.

When I next met Goodwin, a few months later, I mentioned this story and asked him whether it was true and whether he remembered Jensen. His response was a characteristically laconic:

Ah, that gloomy Dane! Yes, it must be true, if he said so!

2. Tâtonnement as an iterative path towards an equilibrium

The famous tâtonnements, by the way, are a swindle, rigorously speaking, and I suspect Walras knew it …

Walras’ great vision, of course, was that of the price system, working like a complicated computer simultaneously to allocate resources, reward services, and distribute goods. All the metaphysics is gone (or almost all—there is a trace or two which Jaffé unerringly attributes to Walras père); there is no more verbal juggling with notions like ‘value’ as distinct from price. (Solow, 1956, p. 88, emphasis added)

Solow, with characteristic directness (and simplicity) identifies two characteristics of the Walrasian system: the ‘swindle’ that was (is) the various tâtonnements,12 but also the fertility of attaching, to the price system, the metaphor of ‘working like a complicated computer’.13 The ‘swindle’, as we now know, has spawned a vast literature of claims, counterclaims and non-claims, both mathematical and doctrine historical, on mathematically effectivising14 one or another interpretation of tâtonnements formally, in the former tradition, or interpreting what Walras actually meant, in the latter line of research.

Goodwin, more ‘diplomatically’ but also in line with his own lifelong research programme—which had crystallised even at that early stage, as I have tried to show in the previous section—referred to the ‘swindle’ as simply a ‘confusion’:

In his treatment [of the problem of the exchange of given quantities of goods, taking production or existing stocks as given, Walras] thoroughly confused two related but distinct questions: the question of the existence of a solution and how to find it, with the question of the reality of a dynamical process and its stability. (Goodwin, 1953, p. 59, emphasis added)

Walras actually ‘thoroughly confused’ not two, but four ‘related but distinct questions’: existence of a solution, a method of finding it (if ‘proved’ to exist), the ‘reality’ of the method considered as a dynamic process and its stability; the latter could be rephrased in terms of a question about the convergence of a dynamic process to the equilibrium, which had apparently been shown to exist. A legion of pioneering contributors to economic theory, all the way from Bortkiewicz and Edgeworth, via Pareto and Pantaleoni to Lange, Patinkin, Morishima and those two modern scholars par excellence of Walras, William Jaffé and Don Walker, have contributed to furthering the Walrasian confusions. Between Jaffé (1967, 1980, 1981) and Walker (1987, 1988),15 all the relevant historical references, related to the ‘thoroughly confused’ issues that Walras raised, are meticulously listed, discussed and interpreted, even if not always with the admirable clarity one expects from these two outstanding doctrinal scholars. The only strand in this genre missed by Jaffé and Walker,16 not surprisingly, is the deep mathematical economics tradition begun by Uzawa (1960, 1962) and Scarf (1960) and continued by Smale (1976) and Saari (1985), with reverberations at the current frontiers of computable general equilibrium theory and computable economics (see, e.g., Velupillai, 2002).

If we take seriously Uzawa’s dual interpretation of the tâtonnements in Uzawa17 (1960), which together with Uzawa (1962) was the fountainhead for the research programme that Scarf initiated and came to be called computable general equilibrium (Scarf, 1973), then the total number of ‘thoroughly confused … related but distinct questions’ becomes six:

In an exchange economy, the competitive market process consists of a price adjustment by which the price of a commodity will rise or fall according to whether there is a positive excess demand or a positive excess supply of the commodity. Walras himself, however, does not make clear what is meant by his tâtonnement process. In particular, he has two distinct tâtonnement processes in mind: the one with simultaneous adjustment, and the other with successive adjustment, both with respect to prices of commodities. (Uzawa, 1960, p. 182, emphasis added)

It is in this sense that I pointed out, 30 years ago, in the context of a discussion of tâtonnement:

Those who are familiar with the great controversies in proof theory and the foundations of mathematics may recognize, in this interpretation [of Walras] by Goodwin, a constructive proof of the existence of equilibrium prices in the Walrasian system. (Velupillai, 1983, p. 76)

The point I wish to highlight in this section is, in contrast to Goodwin’s lifelong work as a testimony to the fact that he was ‘speaking prose all his life’, i.e. inadvertently practising the art of the constructive and computable economist, the explicit claims by even the most distinguished of neoclassical economists—and that class does not come better represented than by Uzawa—that their interpretation of tâtonnement, whichever of the six confusing ways of Walras they choose to work with, does not lead to a computable equilibrium. I have demonstrated this rigorously18 in a series of papers (see, e.g., Velupillai, 2002), but it may be useful to illustrate what I mean by taking the example of the so-called simultaneous tâtonnement in Uzawa (1960, Appendix 1, p. 188),19 with which I have never engaged myself too seriously (partly because it is Uzawa, 1962, that is crucial for computable general equilibrium theory).

Uzawa defines the mapping T, on the set P of normalised price vectors induced by a simultaneous tâtonnement process as:

Where:

and:

Then, by observing that λ(p) > 0 and that T(p) is a continuous mapping from P into itself, Uzawa is able to appeal to the Brouwer fixed-point theorem to prove the existence of a (Walrasian) equilibrium. However the Brouwer fixed-point theorem is neither constructifiable nor implementable as a computable process (due to an appeal to the law of the excluded middle, the law of double negation and the Bolzano–Weierstrass theorem). Let me therefore state this as a proposition.

2.1 Proposition

Any tâtonnement process that underpins the generation of a Walrasian—or any other—equilibrium, so long as it separates the demonstration of the existence of an equilibrium from the construction of a process to achieve it, is numerically meaningless.

2.2 Remark

The caveat ‘numerically meaningless’ is crucial here. Considering the data types that are relevant in economic analysis—whether theoretically or in any applied or empirical sense—the ‘proof’ of this proposition would, at least by me, invoke the kind of framework within which it can be shown that Hilbert’s 10th problem is recursively unsolvable. The addition of the qualifying phrase, ‘so long as it separates the demonstration of the existence of an equilibrium from the construction of a process to achieve it’ may give the appearance of a pointless ‘red herring’. I have added this qualifying phrase as an excuse for not providing a formal ‘proof’ of the proposition here. I do not know how to prove any version of Hilbert’s 10th problem constructively!

This separation of a ‘proof of existence’ from the ‘construction of a process to achieve it’ is precisely what Goodwin always avoided and was the main cause of his misgivings with the original attempts in Walras to devise a process to achieve the equilibrium he had demonstrated as existing (by counting equations and variables—with which method I have no quarrel at all). The sine qua non of a constructive proof of existence—whether of an equilibrium or not—is the non-separation of the two aspects: an existence proof is always accompanied by a procedure to show its constructive feasibility.

Goodwin never referred to, or interested himself in, any of the literature, ostensibly showing the way tâtonnement processes could be used to compute equilibria. He had formulated his approach very clearly, long before these things became frontier topics, partly due to the advent of the digital computer.

3. Goodwin, Turing and Day: viability-creating mechanisms

‘I’m a Sunday mathematician,’ says Goodwin. ‘I have no aptitude for math.’ (‘Ha!’ says Le Corbeiller. ‘Remember, whatever Richard Goodwin tells you about himself, that is by twelve shades an understatement.’) (Ellsberg, 1951, emphasis added)

Richard Goodwin’s mathematical frameworks, to encapsulate issues in analytical economics, were further guided by two very personal insights: linearity to study multisectoral economic structures; non-linearity to understand economic dynamics. But this did not mean the two modes were rigidly separated. Indeed, he always felt—and this was always emphasised in his lectures—that a study of change, which required a non-linear vision, was indispensable to understand structure, which was linearly formulated; and vice versa, in that an understanding of structure gave hints on the kind of non-linear dynamics one should harness to understand change. In many ways it was an enhanced ‘correspondence principle’.

These ideas were not unrelated to Alan Turing’s precept, mentioned in passing in one of his last notes to his friend and former student, Robin Gandy (cf. Hodges, 1983, p. 495):

Description must be non-linear, prediction must be linear.

For Turing too, this did not mean a rigid separation between ‘description’ and ‘prediction’. The analogy with Turing’s precept goes deeper, in a shared vision—at which Goodwin and Turing arrived late in their intellectual lives—of the importance of integrating multisectoral and multifactor interdependent development in structural economic dynamics, in the case of the former, and life and reproduction, in the latter, via the fertile notion of morphogenesis.20 In reflecting on Schumpeter’s vision of the structure, dynamics and evolution of a capitalistic economy, mediated by his knowledge of, and sympathy with, a critical Marxian view of its contradictions, Goodwin came to what I think was a culmination of the way to analyse the complex contours of multisectoral economic dynamics:

Now, after many years … I sympathise much more with [Schumpeter’s] point of view. … Like Marx he was a student of the morphogenetic nature of capitalism. The economy is not a given structure like von Neumann’s model … it is an organism perpetually altering its own structure, generating new forms. Unlike most organisms it does not exhibit durable structural stability: it is perhaps best thought of as a kind of hyper-Darwinian, perpetual evolution. We are so familiar with it, we normally do not realize how remarkable it is. It is not like morphogenesis in animals and plants, where the species is programmed to generate a particular structure, and exhibits structural stability by creating the same form for thousands of years. Rather it is analogous to the much disputed problem of the generation of new species. The economy is unsteadily generating new productive structures. In this sense Schumpeter was profoundly right to reject the elegant new mathematical models: they are the analysis of the behaviour of a given structure. He saw that not only was the economy creatively destroying parts of its given structure, but also that one could not analyze a given structure, ignoring that this cannibalism was going on. (Goodwin, 1989, pp. 107–8, emphasis added)

The spirit and formalism of this cannibalistically evolving dynamic economic structure was given an elegant interpretation by Goodwin’s friend and fellow non-linear-modelling pioneer, Richard Day, at a conference—serendipitously celebrating Ilya Prigogine, who made the Turing bifurcation (in Turing, 1952) work for the Brusselator—where Goodwin was also present to pay his own homage and indebtedness to Day for introducing him to chaotic dynamics:21

Eventually in the process of simulating such a model [a model in which ‘adaptive economizing with feedback’ or ‘adaptive economizing with evolving structure’, which I call ‘recursive programming’ to distinguish it from dynamic programming], some of the feasibility conditions for a given ‘model agent’ will be violated. To restore viability a mechanism must be introduced by the modeler that allows for the formation of new ‘model agents’ to whom the resources associated with disappearing agents are transferred. …

Such viability creating mechanisms are the analog of equilibrium ‘existence’ proofs, but in the out-of-equilibrium setting. They are required to guarantee the existence of a continuing ‘solution’ to the system in terms of feasible actions for all of its constituent model components. When they are explicitly represented, then not only the population of production processes evolve, but also the population of agents, organizations, and institutions. (Day, 1993, pp. 38–9, emphasis added)

I claim that Goodwin’s economic models, both in their structural, linear versions and in the aggregative non-linear dynamic incarnations, were underpinned by adaptive economising units with feedback and evolving structures. It is easy to substantiate this claim, by textual exegesis, of many of the classic Goodwin contributions: see Goodwin (1947, 1949, 1950, 1951, 1953) and even the Dobb Festschrift classic (Goodwin, 1967) and all of his contributions that I am aware of after 1967. If so, what is a formalism of a ‘viability-creating mechanism’ that guarantees the existence of a continuing ‘solution’ to a system in an ‘out-of-equilibrium setting’—especially one that can be interpreted as an ‘analogue of equilibrium “existence” proofs’?

My conjecture is that one formalism for a viability-creating mechanism—consistent with Goodwin’s mathematical modelling philosophy, as I have tried to present it in this essay—is that of a universal Turing machine, capable of self-reconstruction and self-reproduction. If this can be formally substantiated, and I am convinced it can, then, alas, a corollary to it would be the following ‘theorem’.

3.1 Theorem

Viability-creating mechanisms to guarantee the existence of continuing solutions are algorithmically impossible to construct (or impossible to construct algorithmically!).

This is not as discouraging as it may sound! It only means that, once again, Molière’s M. Jourdain asserts himself and thereby another strand of Goodwin’s mathematical modelling philosophy comes to be highlighted: only by structured simulations can one study and learn from ‘organisms perpetually altering their own structure’, endogenously—and non-linearly. That is, after all, exactly what he was doing all the way from 1943 till (at least) 1996. That too is his legacy.

Finally, there is the usual ‘modern’ macroeconomic theorist’s obsession with so-called microfoundation for macrodynamics, which never seems to have bothered this supreme theorist of the non-linear endogenous vision of modelling fluctuations. Here my conjecture is that he worked, albeit implicitly, with his friend Paul Samuelson’s much neglected yet very important observation, made in his Nobel Memorial Prize Lecture:

I must not be too imperialistic in making claims for the applicability of maximum principles in theoretical economics. There are plenty of areas in which they simply do not apply. Take for example my early paper dealing with the interaction of the accelerator and the multiplier. This is an important topic in macroeconomic analysis. …

My point in bringing up the accelerator-multiplier here is that it provides a typical example of a dynamic system that can in no useful sense be related to a maximum problem. By examining the sick we learn something about those who are well; and by examining those who are well we may also learn something about the sick. The fact that the accelerator-multiplier cannot be related to maximizing takes its toll in terms of the intractability of the analysis. (Samuelson, 1972, pp. 10–12, emphasis added)

This ‘duality’ principle, between the ‘sick’ and the ‘healthy’, was that which underpinned the one between ‘linearity’ and ‘nonlinearity’ mentioned above. I believe Goodwin’s ‘correspondence principle’ absorbed this important Samuelsonian observation, of the divide between ‘maximum principles’ and ‘interesting dynamics’. Most of my own recent research has been directed towards an effort at constructing models of macroeconomic dynamics that are formally impossible to be underpinned by any formal maximum principle—indeed dynamics that cannot even be encapsulated in the formalism of the standard theories of differential or difference equations.

I end with Ellsberg’s wonderful reflections on the 38-year-old Goodwin (in 1951), on the eve of his departure to Europe ‘where one could be left, and not left out’ (Goodwin, 1993), first to Cambridge for 28 years and then, for the last 16 years of his life, Siena:

Richard Murphy Goodwin is leaving Harvard at 38, having spent half his life here. Some people think the faculty made a mistake. Others point to factors that might have influenced the appointment board: his late publication[s], his taste for working alone, his non-competitive attitude toward advancement. In particular, some professional scholars tend to feel uneasy about the man with a varsity of interests, the outstanding amateur in so many fields: Can he be taken seriously! One professor, not an economist, has summed up an attitude he may not share himself: ‘It’s all very well to be brilliant at everything: But how can you be sure of a man like that?—who might leave a job teaching economics and go off to spend all his time painting?’

Goodwin has provided one answer to that. Beyond a year at Cambridge University his plans are uncertain, but whatever he will be doing in the future will include teaching.

(Ellsberg, 1951, emphasis added)

Indeed, for a period in the mid-to-late 1950s, he did ‘go off to spend [almost] all his time painting’! Those of us who had the privilege to sit at his feet, in classrooms and lecture halls, will remain eternally grateful that he decided, at the age of 38, that ‘whatever he will be doing in the future will include teaching’.

Appendix

Bibliography

Clower, R. W. and Bushaw, D. W.

Scarf, H. 1960. Some examples of global instability of the competitive equilibrium, International Economic Review, vol.1, no. 3, 157–72

Smale, S. 1976. Dynamics in general equilibrium theory, American Economic Review, vol. 66, no.2, 288–94, May

The reason for italicising three phrases in such a short quote, surely, needs a justification! The interrelated reasons are the connections I seek between iterative processes, as recursive mechanisms, that are intrinsically dynamic, whether in the context of analogue or digital computing machines. Goodwin however was interpreting ‘computing machine’ in its analogue senses, at that time (he later changed his mind), and therefore the equations that were being solved by ‘trial and error’ methods were discretised versions of continuous dynamical systems. The cavalier way in which economists discretise (nonlinear) dynamical systems continues unabated these days, even after almost a century and a half of attempts at computing the dynamics of economics.

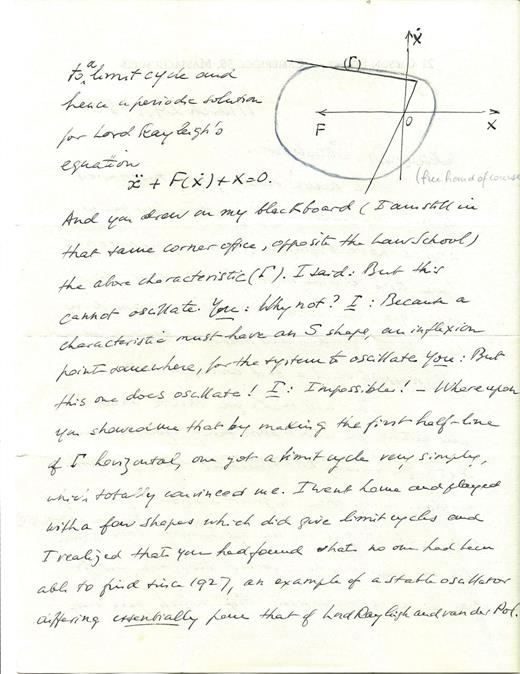

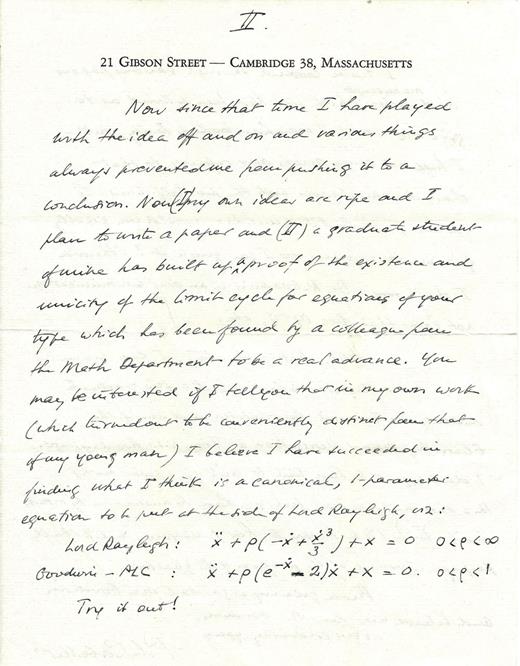

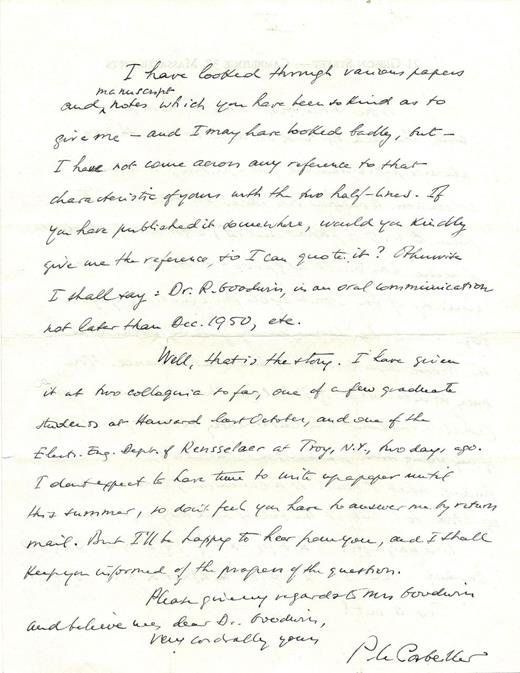

I append the letter from P. Le Corbeiller to Goodwin, dated 29 March 1958, which is a priceless document illustrating the way Goodwin came to the conclusion that a characteristic with only one bend—‘one non-linearity’ as Goodwin called it—was sufficient to generate a limit cycle on the plane. See also Goodwin (1950). The current generation of economists may not be too familiar with the names of P. Le Corbeiller, Otto Rössler and even Daniel Ellsberg (except in his role as one who, together with Allais and others, was responsible for constructing examples of anomalies in the orthodox framework of expected utility maximisation). The best I can do here, given space constraints, is to refer the interested reader to Velupillai (1998) and Goodwin (1990), to appreciate the pervasive beneficial influence of the Rössler system on the way Goodwin came to a happy synthesis of his visions of non-linear economic dynamics.

However it is not the kind of ‘mindless simulation’ that is currently fashionable in many frontiers of so-called computational economics, agent-based economics and even stock-flow-consistent modelling of disaggregative economies. Goodwin’s simulations were in the mode of what I have come to call the Fermi–Pasta–Ulam method of analysis (Fermi et al., 1955) and its perfect execution was in Goodwin (1947). I have always maintained that this is the original and proper way to do ‘agent-based economics’.

Goodwin ‘reduced’ the cubic characteristic, with ‘two bends’, in the van der Pol equation:

with the equation for the one-sided oscillator, i.e. with an exponential characteristic, with ‘one bend’:

He derived it geometrically; the analytic expression was provided by Le Corbeiller (1960). Otto Rössler, inspired by the mechanism of a taffy machine (cf. Gurstelle, 2008), replaced the Lorenz system (with two non-linearities):

with his own celebrated simpler system (with one non-linearity):

Granting the cliché that any model, particularly when mathematised, is an abstraction, which is surely a euphemism for the ‘unrealistic’ in this sentence, not the kind of unrealism associated with the ‘as if’ philosophy of the instrumentalists.

Synonyms for ‘solvability’, in this particular context, could be ‘computability’—meaning ‘methods of numerical analysis for solving equations’; computability, here, does not refer to its sense in recursion theory.

Pasinetti’s claim (Pasinetti, 2007, p. 206, emphasis added) that, at the Frostavallen Wicksell symposium in 1977 (at which I was also present), ‘Goodwin attempted the more constructive task of using new mathematical tools to gain some further insights (“capital theory in orthogonalised general coordinates…”)’, is slightly incorrect. The use of ‘orthogonalised general coordinates’ was not a case of ‘using new mathematical tools’. Goodwin had been using ‘normal coordinates’ at least since 1947. The word ‘constructive’ in this quote has nothing whatsoever to do with any aspect of constructive mathematics.

Proof in any mathematical or mathematical logic variant (constructive, formal, Platonic or whatever mode).

It is not for nothing that Goodwin was the custodian of the Cambridge Phillips Machine, more aptly known as the MONIAC (MOnetary National Income Analogue Computer; cf. Velupillai, 2011B). He taught macroeconomics to students taking the Principles option in the Economics Tripos at Cambridge using an active MONIAC, especially to illustrate stabilisation policy in all its transparency (see Goodwin, 2000).

Goodwin knew nothing about computability theory, constructive analysis, Turing machines, constructive proofs or any such thing—till I started talking to him, from about 1981, about their relevance to economics in general and to his way of doing economics in particular. It was a typical case of Molière’s Le Bourgeois Gentilhomme, M. Jourdain, unknowingly speaking prose all his life!

Arne Jensen had already, before meeting Goodwin, published an interesting article in an early issue of Metroeconomica (Jensen, 1953) and was, through that, familiar with Goodwin (1951 B).

Jaffé’s caveat to this pungent characterisation by Solow can be found in his famous and—for me, at least—welcome mea culpa article (Jaffé, 1981, p. 317), where he approved, handsomely (ibid., p. 329; see also below), Goodwin’s interpretation of the ‘swindle’ (in Goodwin, 1951B, 1953).

Surely the famous socialist calculation debate emanates from this interpretation of the Walrasian price system? I would like to add that this debate continues the noble tradition of confusion by being quite cavalier about the nature of the computing machine that is invoked; in particular, without any clear indication of whether the market is an analogue or a digital computer. This is not a trivial issue, especially—but not only—because of the nature of the data that the one or the other computer can process effectively.

I am of course using the word effectivising in its strict recursion theoretic or constructive sense, with the ‘licence’ to use the word also as a constructive process, even without respecting the logic of any particular variety of constructivism.

I think I am partly responsible for the appearance of the unfortunate Walker (1988), with its uncompromising misunderstandings and ‘thoroughly confused’ reading and interpretations of Goodwin (1951B, 1953). Don Walker, a friend, visited me at my home in southern Sweden in 1987, after my appearance at the Boston meetings of the History of Economics Society, of which he was a leading light. During his visit at my home we discussed ‘dis & dat’ and Goodwin on Walras. I referred Walker, then, to Goodwin (1951B, 1953), which resulted in Walker (1988). Had Walker any knowledge of the Goodwin ‘research programme’ I tried to outline in the previous section, the misinterpretations could have been mitigated, but not entirely eliminated.

Both Jaffé and Walker refer, in what I cannot but call a ‘gratuitous’ mode, to Arrow and Hahn’s equally vacuous mention of the Gauss–Seidel method (Arrow and Hahn, 1971). The latter state that the Gauss–Seidel method ‘is not particularly attractive as computational means’ (ibid., p. 306, emphasis added), which is then quoted without qualification by both Jaffé (see, e.g., 1981, p. 329) and Walker (1988, p. 300). Had any of these worthies read Uzawa (1960, especially p. 181, footnote 1) carefully, their comments would have been less meaningless. Whether a particular algorithm is computationally attractive or not depends on the structure and form of the problem on which it is to be used. It is not as if any of the mappings in Arrow and Hahn (1971) are computationally attractive either!

Two doctrine-historical observations by Uzawa, in this classic, make me wonder whether his credentials in this thorny field are to be trusted. The first is advice to the reader to see the appendix in Patinkin (1956—the first edition of Patinkin, 1965) for ‘the most complete treatment of the theory of tâtonnement’ (p. 182); the second is his reference to Clower and Bushaw (1954) as ‘the first application of Lyapunov’s second method to the [sic!] economic analysis’ (p. 185). I disagree with the former but agree with the latter claim. On the first, see Walker (1987, p. 772); on the second, see Velupillai (2011A, pp. 23, 27). In Velupillai (1983, p. 76), I did point out that Patinkin handsomely acknowledged Jaffé’s endorsement of the Goodwin interpretation of tâtonnement. Moreover, I also broached the main theme of this section, referring to both Goodwin (1951B, 1953) and Uzawa (1962): the constructive nature of tâtonnement.

However one wishes to define this word!

Incidentally, Uzawa’s Secretary of Market (ibid., p. 184) is what later came to be called the Walrasian Auctioneer by Leijonhufvud, using an unfortunate and inappropriate analogy with Maxwell’s Demon. The bootlegging of entropy that Maxwell’s Demon had to indulge in, elegantly explained by Szilard, applies, with trivial analytical adaptations, also to the bootlegging of information by Uzawa’s Secretary of Market.

Even here, the analogy may be extended back through time in the common influence of D’Arcy Thompson’s classic Growth and Form (Thompson, 1917) on both Turing (cf. Hodges, op. cit. and Sara Turing, 2012) and Goodwin. I remember one melancholy episode of my many wonderful memories of ‘life with Goodwin’. In 1980, just before his formal retirement at Cambridge, I went to Goodwin’s flat at Belvoir Terrace to have a cup of espresso, which he made by grinding coffee beans for each cup, using his classic Neapolitan espresso device on a gas fire. While we were seated in his elegant though sparse kitchen-cum-dining area, I saw an old-fashioned bookshelf with some true classics: all Schumpeter’s books, as well as the first edition of the D’Arcy Thompson classic. He then asked me whether I wanted any of them and, with considerable embarrassment, I expressed a desire to have the Schumpeter classics and Growth and Form. He immediately went up to the shelf and placed notes in the individual books, to the effect that they were to be bequeathed to me, eventually. Alas, soon after his death his home was burgled very badly and I never ‘inherited’ any of them.

Richard Day during a visit to Siena and Otto Rössler, when Goodwin visited him in Tübingen, are credited with introducing him to the weird and wonderful world of chaotic dynamics. This was, surely, a replay of the episode with Phillippe Le Corbeiller in the early 1940s and his personal tutoring of Goodwin in the mysteries of planar non-linear dynamics.